The Greatest Guide To Medigap Agent Near Me

Wiki Article

Some Known Details About Medigap Agent Near Me

Table of ContentsThe Single Strategy To Use For Medigap Agent Near MeIndicators on Medigap Agent Near Me You Need To KnowMedigap Agent Near Me for DummiesMedigap Agent Near Me for BeginnersThe 2-Minute Rule for Medigap Agent Near Me

These activities may include advertising, technology, training, and compliance; the firms work as an intermediary in between representatives and also insurance providers. Unlike enrollment compensations, management settlements are not set by any kind of controling or regulatory body; rather, they are established by insurers in negotiation with each independent firm. For MA as well as Part D, CMS's Medicare advertising guidelines develop that these payments "have to not go beyond FMV or an amount that equals with the quantities paid to a third party for comparable services during each of the previous 2 years." These repayments give an additional channel of monetary assistance between insurers and also firms as well as representatives.

Our evaluation from 2016, 2018, as well as 2020 recommends that considering that average costs in Medigap have gone down, representative payment (a portion of the costs) also has lowered. Alternatively, while MA costs have decreased, representative settlement (set by CMS) has increased at a rate that has gone beyond inflation.1 Our evaluation has four core effects for policymakers.

How Medigap Agent Near Me can Save You Time, Stress, and Money.

g., growth of a certain MA item over one more, or development of MA organization over Medigap). This could develop one more dispute of passion. Raising openness and also reporting on carriers' real payment repayments instead of the CMS-defined maximums across MA, Component D, as well as Medigap might aid resolve this. Policymakers likewise need to consider added regulatory quality around the administrative payments, incentives, and various other forms of settlement.MA as well as Component D strategies are gauged through the celebrity ratings program as well as are compensated in different ways for supplying a high-quality member experience. Pay-for-performance can be taken into consideration part of the payment model for representatives and also firms. And fourth, the renewalcommissions version is a double-edged sword. Making sure commissions even if recipients remain with their initial plans may assist protect against unneeded switching.

Policymakers can take into consideration defining a minimum degree a knockout post of service needed to make the revival or changing compensation. Representatives are an important source for beneficiaries, but we should reimagine payment to make sure that motivations are a lot more very closely straightened with the objectives of supplying support and also guidance to recipients and also without the risk of completing financial interests.

An Unbiased View of Medigap Agent Near Me

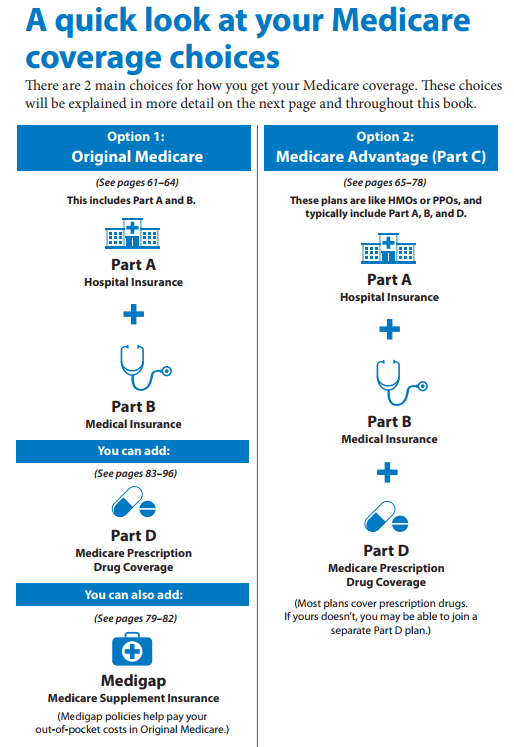

It prevails for people seeking a new health insurance strategy to go with an insurance coverage representative, however is this needed when it involves Medicare? The scenario will vary depending on the kind of Medicare you want. If you do select to opt for a representative, the details can still make the process differ commonly.If you're simply planning to sign up in Original Medicare (Medicare Parts An as well as B), then you will not need to use an insurance policy agent. As a matter of fact, you won't have the ability to make use of an insurance coverage agent-- this kind of Medicare is only available from the federal government. Insurance representatives will certainly never enter into the image.

This is since Component D plans are marketed by personal insurance firms. Medicare Advantage is by far one of the most common kind of Medicare insurance coverage that is offered via insurance agents. Medicare Advantage intends, likewise referred to as Part C plans, are essentially a way of getting your health care protection via a personal plan.

Medigap Agent Near Me Can Be Fun For Anyone

Some Part C prepares featured prescription medication plans bundled with them, and some don't (Medigap Agent Near me). If your own does not included a PDP, then it can be possible to get Component C from one business and Part D from an additional, while collaborating with two different agents for each strategy. Medicare Supplement prepares, Medigap Agent Near me also referred to as Medigap plans, are strategies that cover out-of-pocket prices under check my source Medicare.When it comes to Medicare insurance policy agents, there are typically two types: captive as well as independent. Both can be licensed to market Medicare.

The standard manner in which you can believe of restricted versus independent agents is that restricted representatives are sales reps that are contracted to market a details insurance item. Independent representatives, on the various other hand, are extra like insurance policy brokers, implying that they can sell you any kind of insurance product, and also aren't limited to one company - Medigap Agent Near me.

Not known Facts About Medigap Agent Near Me

This way, you can consider them as analogous to an auto sales representative; they offer one type of product for one firm, as well as probably are paid by means of compensation. Independent representatives are merely people who offer insurance-related items. They can market an insurance coverage plan from Company A to one individual and Firm B to an additional, which is something restricted representatives merely can not do.As you can imagine, there is a much greater level of freedom that features working with an independent insurance representative instead of a captive one. Independent representatives can check out every one of the insurance policy items they have access to as well as try to find the one that works ideal for you, while captive representatives can only market you one certain thing, which might not be a great fit.

Report this wiki page